Already Paid Off Your Student Loans? You Can Still Get a Refund

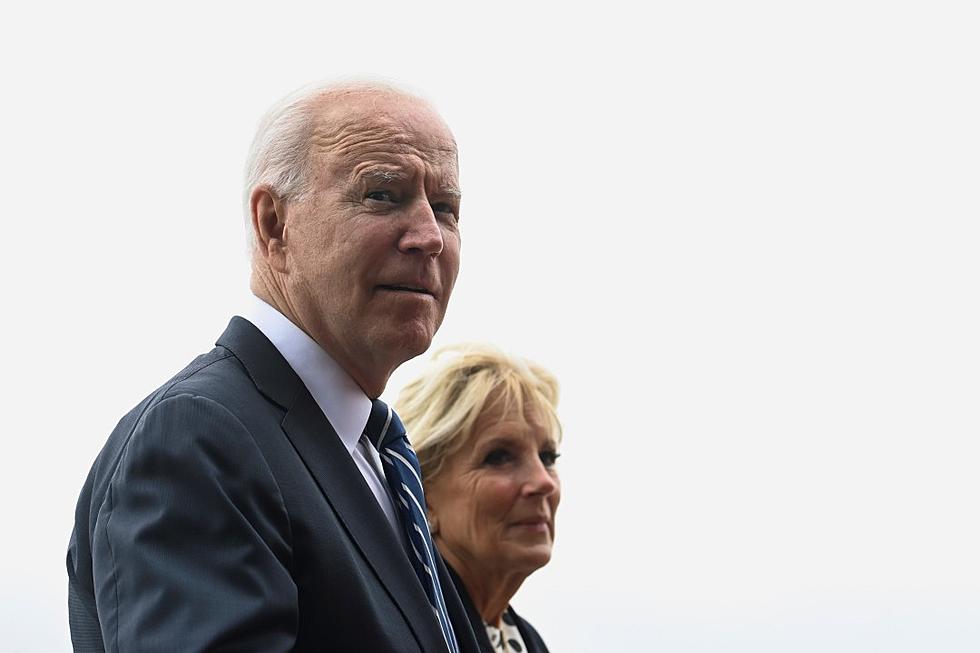

Many of you have questions about President Biden's plan to cancel student loans. A lot of people who still have large balances on their educational loans are thrilled at the aspect of not having to repay $10,000 in federal loans or perhaps $20,000 in Pell Grants. However, those who have already paid off their educational loans still have a question, namely, "What about Me"?

Well, the short answer to that question is this. You may still be eligible for the President's plan. But, it's going to take a little, no a lot, of leg work on your part. First things first, let's see who actually qualifies for this program. To qualify for the program you'll need to have earned less than $125,000 in 2020 and or 2021. That figure is $250,000 for a combined household income.

If you qualify you'll have to wait for applications to become available. The Feds estimate that those applications will be available by mid-October. Once you've applied you can expect a wait of about a month or a month and a half before you see the adjustment on your loan.

That adjustment should take place before the end of the year. That is when payments on student loans will once again restart. Those payments have been on hold since March of 2020 because of the COVID-19 pandemic.

Currently, the President's plan only applies to those who have a current loan balance and any borrower who made a payment on their loans since the start of the moratorium on payments back in March of last year. You can actually get a refund on those payments if they were made after March 13, 2020. You'll need to contact your loan services advisor to complete that adjustment.

What you'll wind up doing is asking your loan advisor to restore the balance so you can be refunded the payment. Once that balance has been restored then the "forgiveness payment" can be applied. But you'll need to know that the refund is capped at the level of the outstanding debt, so you won't be refunded the difference of the $10,000 or the $20,000.

Confusing? Of course, it is, that's the government's way. Chances are you're not going to be able to navigate the process without reaching out for assistance. If you need to contact your loan provider, here's how you do that. If you have more questions than we've been able to answer, you can find those here. If you're wondering where to get an application for the program, that's right here.

10 Little Things that Grind Our Gears in a Great Big Way

More From Cajun Radio 1290 AM